Food and Beverage Industry

We deliver decisive value across nearly every aspect of your business.

Few businesses grapple with more changeability, operational complexity or commodity price risk than companies in the food and beverage industry. The StoneX Financial Inc. – FCM Division Commodity EDGE-X team understands these challenges and leverages extensive market access and deep expertise to help food processors, manufacturers and consumer packaged goods companies overcome them. Specifically, we work hand-in-hand with clients to:

- Set and achieve budget goals.

- Drive profits

- Protect margins from commodity price volatility.

- Develop and execute short and long term procurement strategies.

- Defend and expand market share.

We understand your whole business

Decades of working with clients in this space have taught us that nearly every aspect of your operation has at least some exposure to commodity price volatility. Most companies try to address the most obvious sources, like primary ingredient prices. In our experience, the most successful companies take a holistic approach to commodity consumption across all the aspects of their business.

| Facet of Business | Key Costs | Bottom-Line Impacts |

| Production/ Service |

|

Product margins |

| Operations |

|

|

| Financial |

|

|

We’re connected to the commodity markets that drive your costs

The Commodity EDGE-X team connects clients to extensive commodity market expertise, starting with a comprehensive market intelligence offering that spans the markets of most interest to the food and beverage industry including dairy, grains, meats and livestock, sugar, cocoa, coffee, and energy.

For every market, we can offer:

- Fundamental Drivers

- Technical Analysis

- Historical Comparison

- Predictive Analytics

- Hedge Strategy Recommendations

We know that no two businesses are the same

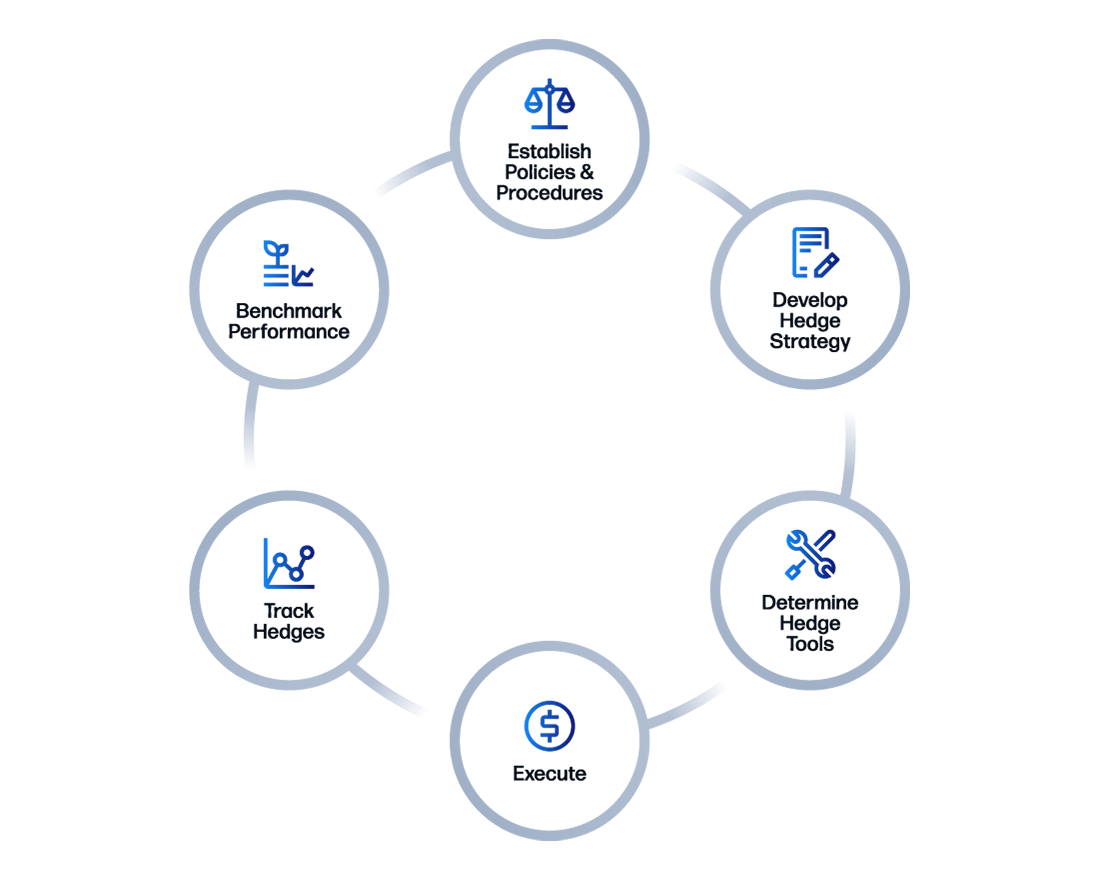

All food and beverage companies face commodity price risk, but each one is unique in their needs – and where they are in the process of managing that risk. That’s why we employ a structured but highly flexible process for helping customers develop and implement effective risk management strategies. We will put together a customized package that fits your risk management needs.

We pair intel with expertise to manage your risk

StoneX delivers a comprehensive suite of risk management solutions designed to work across every facet of your business.

|

CONSULTING We strive to simplify the world’s complex markets for our clients by educating them on the risks they face and the tools available to reduce their price risk and protect their profits. |

EXECUTION From executing & clearing futures and options trades on nearly all the world’s exchanges, to building specialized OTC and physical hedging strategies, our team provides clients with the most sophisticated risk management tools available. |

RISK SOFTWARE Daily transparency into your commodity portfolio is crucial in order to make informed decisions on your business. Know-Risk™ is our cloud based software designed to simplify the management of your commodity price risk. |

| Hedge Seminars & Continuous Education | Futures & Options Clearing | Physical & Financial Deal Capture |

| Risk Assessment & Policy Development | OTC Swap Dealer | Mark to Market & Variance to Budget |

| Hedge Program Design | Physical Commodity Brokerage | Stress & What If Scenarios |

| Market & Strategy Analysis | Retail Natural Gas & Electricity | Hedge Program Tracking |

Partner with us

We work with businesses in North America, Europe, and Asia. To learn more about how we can work with you to protect your margins from commodity price risk and give you an edge in planning strategically, securing market share and driving profitability, please reach out to our team today.